Finance Research Group Working Papers,

University of Aarhus, Aarhus School of Business, Department of Business Studies

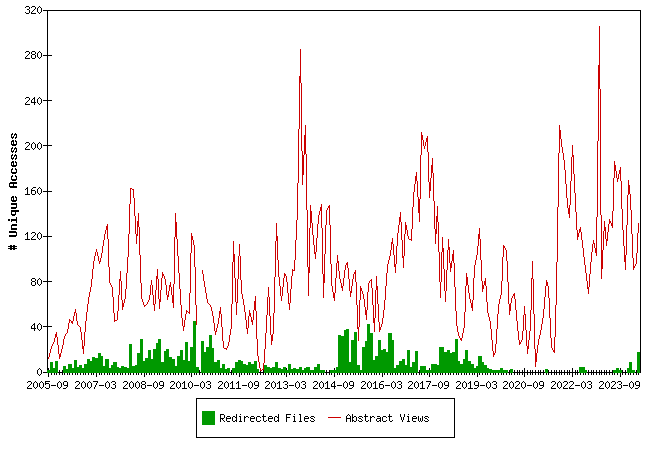

Downloads from EBLSG

Fulltext files are files downloaded from the EBLSG server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

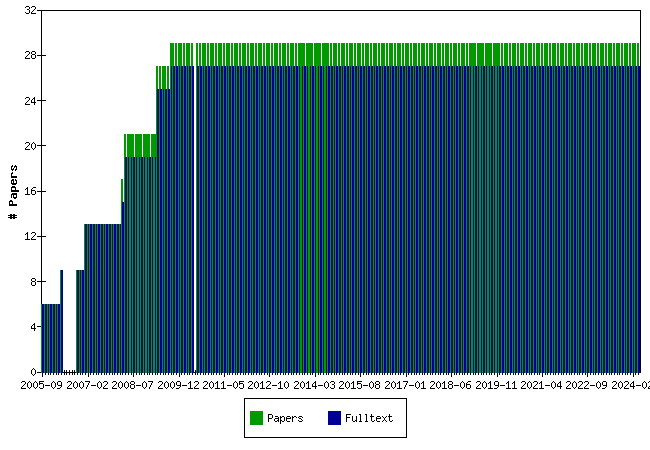

Papers at EBLSG

Top papers by Abstract Accesses last month (2024-03)

Top papers by Abstract Accesses last 3 months (2024-01 to 2024-03)

Top papers by Downloads last 3 months (2024-01 to 2024-03)

| Paper | Downloads |

|---|---|

| Decomposing European bond and equity volatility Charlotte Christiansen | 1 |

| A Consistent Pricing Model for Index Options and Volatility Derivatives Rama Cont, Thomas Kokholm | 1 |

| Investment Timing, Liquidity, and Agency Costs of Debt Stefan Hirth, Marliese Uhrig-Homburg | 1 |

| Estimating US Monetary Policy Shocks Using a Factor-Augmented Vector Autoregression: An EM Algorithm Approach Lasse Bork | 1 |

| Dispersed Trading and the Prevention of Market Failure: The Case of the Copenhagen Stock Exchange David C. Porter, Carsten Tanggaard, Daniel G. Weaver, Wei Yu | 1 |

| The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application Espen P. Høg, Per H. Frederiksen | 1 |

| Lapse Rate Modeling: A Rational Expectation Approach Domenico De Giovanni | 1 |

| The Forecast Performance of Competing Implied Volatility Measures: The Case of Individual Stocks Leonidas Tsiaras | 1 |

| Sato Processes in Default Modeling Thomas Kokholm, Elisa Nicolato | 1 |

Top papers by Abstract Accesses all months (from 2005-09)

| Paper | Accesses |

|---|---|

| Debt and Taxes: Evidence from bank-financed unlisted firms Jan Bartholdy, Cesário Mateus | 931 |

| Realized Bond-Stock Correlation: Macroeconomic Announcement Effects Charlotte Christiansen, Angelo Ranaldo | 910 |

| A Consistent Pricing Model for Index Options and Volatility Derivatives Rama Cont, Thomas Kokholm | 895 |

| The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application Espen P. Høg, Per H. Frederiksen | 891 |

| Traffic Light Options Peter Løchte | 869 |

| Danish Mutual Fund Performance - Selectivity, Market Timing and Persistence. Michael Christensen | 842 |

| Conducting event studies on a small stock exchange Jan Bartholdy, Dennis Olson, Paula Peare | 777 |

| Decomposing European bond and equity volatility Charlotte Christiansen | 694 |

| Private benefits in corporate control transactions Thomas Poulsen | 680 |

| GSE Funding Advantages and Mortgagor Benefits: Answers from Asset Pricing Søren Willemann | 673 |

Top papers by Downloads all months (from 2005-09)

| Paper | Downloads |

|---|---|

| Pricing the Option to Surrender in Incomplete Markets Andrea Consiglio, Domenico De Giovanni | 285 |

| Lapse Rate Modeling: A Rational Expectation Approach Domenico De Giovanni | 126 |

| The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application Espen P. Høg, Per H. Frederiksen | 124 |

| Danish Mutual Fund Performance - Selectivity, Market Timing and Persistence. Michael Christensen | 115 |

| Conducting event studies on a small stock exchange Jan Bartholdy, Dennis Olson, Paula Peare | 99 |

| Debt and Taxes: Evidence from bank-financed unlisted firms Jan Bartholdy, Cesário Mateus | 85 |

| A Consistent Pricing Model for Index Options and Volatility Derivatives Rama Cont, Thomas Kokholm | 79 |

| Realized Bond-Stock Correlation: Macroeconomic Announcement Effects Charlotte Christiansen, Angelo Ranaldo | 60 |

| On the Generalized Brownian Motion and its Applications in Finance Esben Høg, Per Frederiksen, Daniel Schiemert | 57 |

| Investment decisions with benefits of control Thomas Poulsen | 56 |

- University of Aarhus, Aarhus School of Business, Department of Business Studies

- Home page for this series

Questions (including download problems) about the papers in this series should be directed to Helle Vinbaek Stenholt ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2024-04-01 05:48:44.