Finance Working Papers,

University of Aarhus, Aarhus School of Business, Department of Business Studies

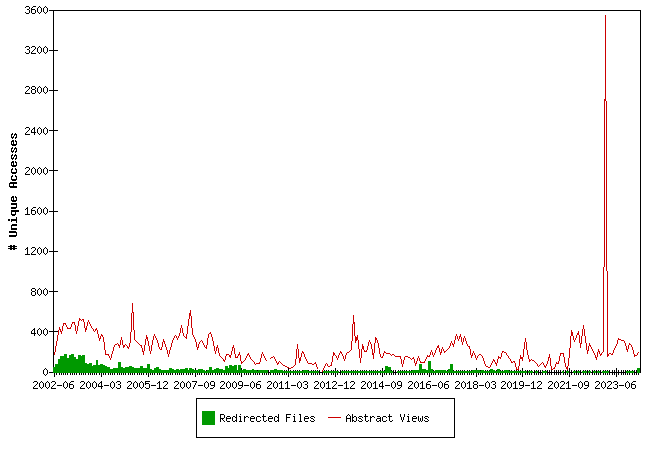

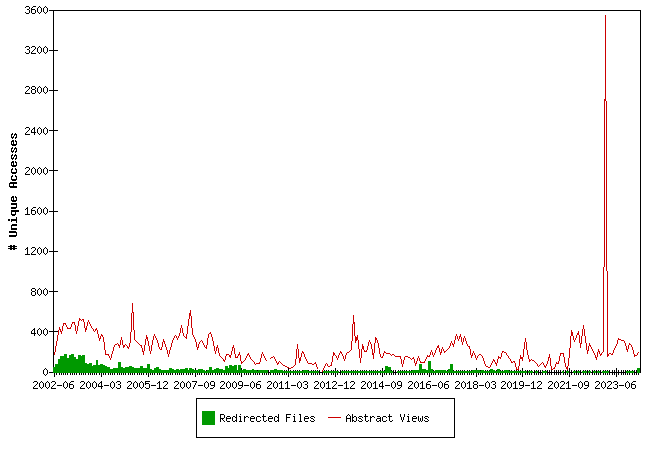

Downloads from EBLSG

Fulltext files are files downloaded from the EBLSG server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

The raw data

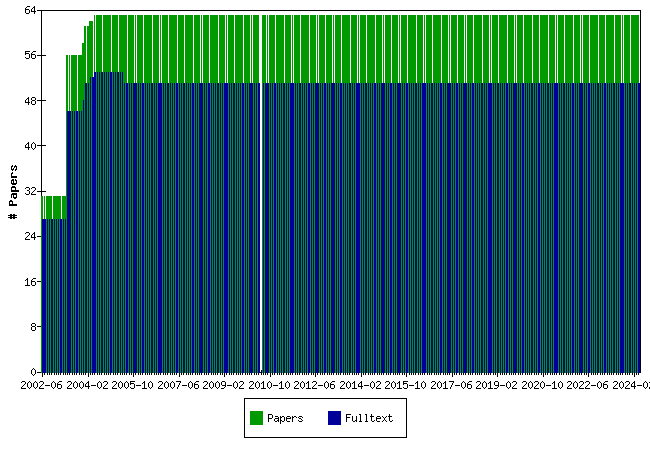

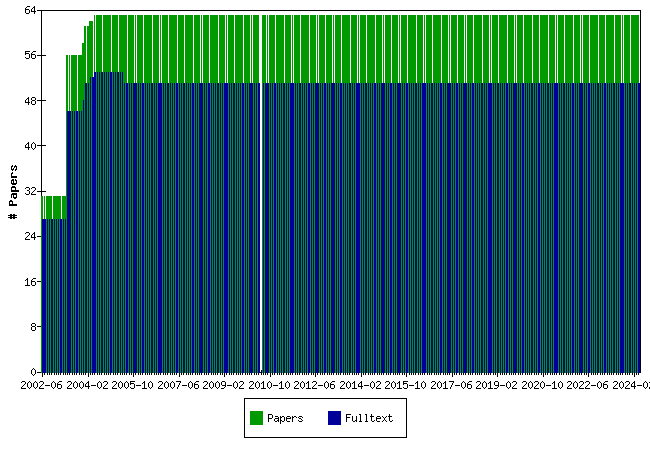

Papers at EBLSG

The raw data

Top papers by Abstract Accesses last month (2024-03)

| Paper | Accesses |

Credit Spreads and the Term Structure of Interest Rates.

Charlotte Christiansen | 7 |

Conditional moment testing, term premia and affine term structure models

Jes Taulbjerg | 5 |

Boundary and Bias Correction in Kernel Hazard Estimation

Jens Perch Nielsen, Carsten Tanggaard | 5 |

Longevity Studies Based on Kernel Hazard Estimation.

Angie Felipe, Montserrat Guillen, Jens Perch Nielsen | 5 |

Further Evidence on Hedge Funds Performance.

Claus Bang Christiansen, Peter Brink Madsen, Michael Christensen | 4 |

A Finite Difference Approach to the Valuation of Path Dependent Life Insurance Liabilities.

Anders Grosen, Bjarke Jensen, Peter Løchte Jørgensen | 4 |

Real Supply Shocks and the Money Growth-Inflation Relationship.

Michael Christensen | 4 |

Estimating the Consumption-Capital Asset Pricing Model without Consumption Data: Evidence from Denmark

Anne-Sofie Reng Rasmussen | 4 |

Long-Run Forecasting in Multicointegrated Systems

Boriss Siliverstovs, Tom Engsted, Niels Haldrup | 4 |

Estimating quadratic term structure models by non-linear filtering

Jes Taulbjerg | 4 |

Exchange Rate Dynamics in a General Equilibrium Model with Decreasing Returns to Labor.

Allan Bødskov Andersen | 4 |

Hedging with a Misspecified Model

Nicki Søndergaard Rasmussen | 4 |

A New Daily Dividend-adjusted Index for the Danish Stock Market, 1985-2002: Construction, Statistical Properties, and Return Predictability

Klaus Belter, Tom Engsted, Carsten Tanggaard | 4 |

Volatility-Spillover E ffects in European Bond Markets

Charlotte Christiansen | 4 |

Rank papers for other periods

Top papers by Abstract Accesses last 3 months (2024-01 to 2024-03)

| Paper | Accesses |

Credit Spreads and the Term Structure of Interest Rates.

Charlotte Christiansen | 19 |

A Finite Difference Approach to the Valuation of Path Dependent Life Insurance Liabilities.

Anders Grosen, Bjarke Jensen, Peter Løchte Jørgensen | 15 |

A New Daily Dividend-adjusted Index for the Danish Stock Market, 1985-2002: Construction, Statistical Properties, and Return Predictability

Klaus Belter, Tom Engsted, Carsten Tanggaard | 15 |

Evaluating Danish Mutual Fund Performance

Michael Christensen | 15 |

Estimating the Consumption-Capital Asset Pricing Model without Consumption Data: Evidence from Denmark

Anne-Sofie Reng Rasmussen | 14 |

Conditional moment testing, term premia and affine term structure models

Jes Taulbjerg | 12 |

Boundary and Bias Correction in Kernel Hazard Estimation

Jens Perch Nielsen, Carsten Tanggaard | 12 |

An Empirical Study of the Term Structure of Interest Rates in Denmark, 1993 – 2002

Charlotte Christiansen, Tom Engsted, Svend Jakobsen, Carsten Tanggaard | 12 |

Real Supply Shocks and the Money Growth-Inflation Relationship.

Michael Christensen | 11 |

Speculative bubbles in stock prices? Tests based on the price-dividend ratio.

Tom Engsted, Carsten Tanggaard | 11 |

Bootstrap Inference in Semiparametric Generalized Additive Models.

Wolfgang Härdle, Sylvie Huet, Enno Mammen, Stefan Sperlich | 11 |

Co-integration and exponential-affine models of the term structure

Jes Taulbjerg | 11 |

Misspecification versus bubbles in hyperinflation data: Comment.

Tom Engsted | 11 |

The Educational Asset Market: A Finance Perspective on Human Capital Investment

Charlotte Christiansen, Helena Skyt Nielsen | 11 |

Errors in Trade Classification: Consequences and Remedies.

Carsten Tanggaard | 11 |

Testing for Multiple Types of Marginal Investor in Ex-day Pricing

Jan Bartholdy, Kate Briown | 11 |

Estimating quadratic term structure models by non-linear filtering

Jes Taulbjerg | 11 |

Rank papers for other periods

Top papers by Downloads last 3 months (2024-01 to 2024-03)

Rank papers for other periods

Top papers by Abstract Accesses all months (from 2002-06)

| Paper | Accesses |

Credit Spreads and the Term Structure of Interest Rates.

Charlotte Christiansen | 1867 |

Revisiting the shape of the yield curve: the effect of interest rate volatility.

Charlotte Christiansen, Jesper Lund | 1762 |

Cross-Currency LIBOR Market Models.

Peter Mikkelsen | 1458 |

Implied Volatility of Interest Rate Options: An Empirical Investigation of the Market Model.

Charlotte Christiansen, Charlotte Strunk Hansen | 1418 |

MCMC Based Estimation of Term Structure Models.

Peter Mikkelsen | 1403 |

A Finite Difference Approach to the Valuation of Path Dependent Life Insurance Liabilities.

Anders Grosen, Bjarke Jensen, Peter Løchte Jørgensen | 1345 |

Real Supply Shocks and the Money Growth-Inflation Relationship.

Michael Christensen | 1284 |

An Empirical Study of the Term Structure of Interest Rates in Denmark, 1993 – 2002

Charlotte Christiansen, Tom Engsted, Svend Jakobsen, Carsten Tanggaard | 1237 |

Evaluating the C-CAPM and the Equity Premium Puzzle at Short and Long Horizons: A Markovian Bootstrap Approach.

Tom Engsted, Enno Mammen, Carsten Tanggaard | 1129 |

Bootstrap Inference in Semiparametric Generalized Additive Models.

Wolfgang Härdle, Sylvie Huet, Enno Mammen, Stefan Sperlich | 1120 |

Rank papers for other periods

Top papers by Downloads all months (from 2002-06)

Rank papers for other periods

Questions (including download problems) about the papers in this series should be directed to Helle Vinbaek Stenholt ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2024-04-01 05:48:45.