Working Papers,

Copenhagen Business School, Department of Finance

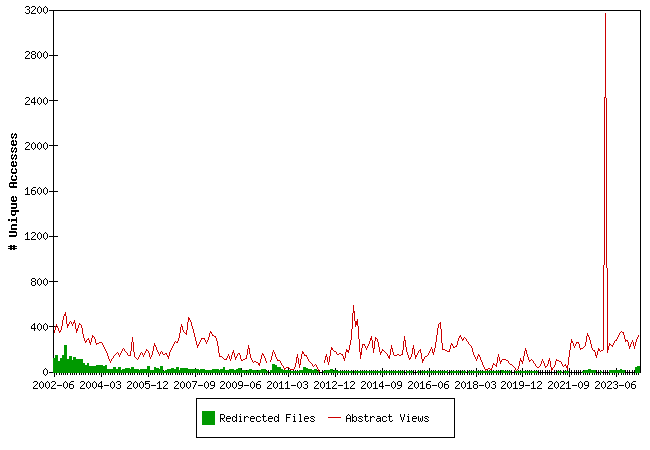

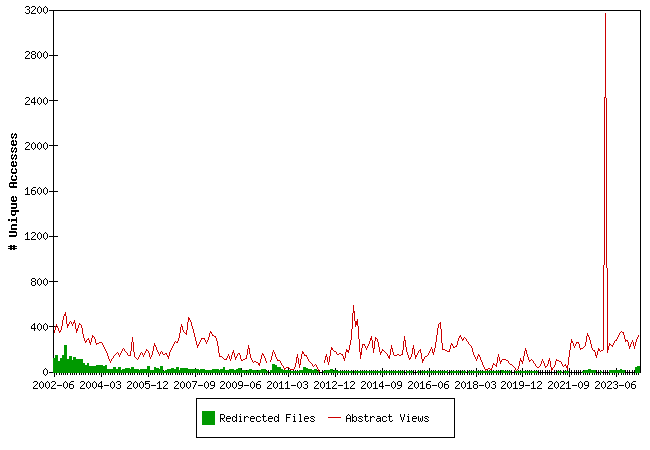

Downloads from EBLSG

Fulltext files are files downloaded from the EBLSG server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

The raw data

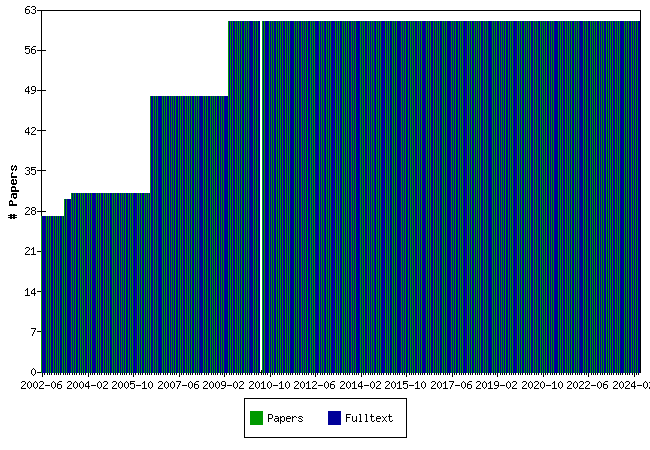

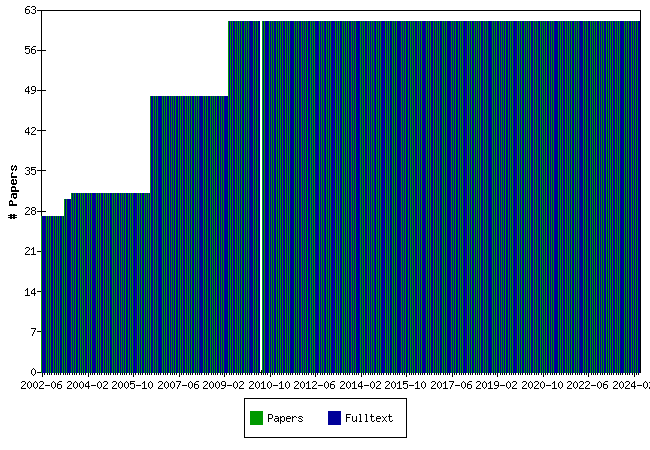

Papers at EBLSG

The raw data

Top papers by Abstract Accesses last month (2024-03)

| Paper | Accesses |

Changes in The Bid-Ask Components Around Earnings Announcements: Evidence from the Copenhagen Stock Exchange

Torben Voetmann | 10 |

The housing price downturn and its effects ? a discussion

Jens Lunde | 8 |

Impact of Takeover Defenses on Managerial Incentives

Caspar Rose | 7 |

Legal pre-emption rights as call-options, redistribution and efficiency loss

Michael Møller, Caspar Rose | 7 |

Rating mutual funds

Ken L. Bechmann, Jesper Rangvid | 7 |

On Volatility induced Stationarity for Stochastic Differential Equations

J.M.P J.M.PAlbin, Bjarne Astrup Jensen, Anders Muszta, Richter Martin | 7 |

Optimal Consumption and Investment Strategies with Stochastic Interest Rates

Carsten Sørensen, Claus Munk | 7 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 7 |

Seasonality in Agricultural Commodity Futures

Carsten Sørensen | 7 |

Lognormal Approximation of Complex Pathdependent Pension Scheme Payoffs

Peter Løchte Jørgensen | 6 |

The Optimal Standard of Proof in Criminal Law When Both Fairness and Deterrence Matter

Henrik Lando | 6 |

Dynamic asset allocation and latent variables

Carsten Sørensen, Anders Bjerre Trolle | 6 |

The owner-occupiers’ capital structure during a house price boom

Jens Lunde | 6 |

Distributions of owner-occupiers' housing wealth, debt and interest expenditureratios as financial soundness indicators

Jens Lunde | 6 |

On the Pricing of Step-Up Bonds in the European Telecom Sector

David Lando, Allan Mortensen | 6 |

Higher-Order Finite Element Solutions of Option Prices

Peter Raahauge | 6 |

MOMSAFLØFTNING OG KREDITFORVRIDNING

Bjarne Florentsen, Michael Møller, Niels Chr. Nielsen | 6 |

Price and Volume Effects Associated with Changes in the Danish Blue-Chip Index - The KFX Index

Ken L. Bechmann | 6 |

CEO Turnovers and Corporate Governance: Evidence from the Copenhagen Stock Exchange

Robert Neumann, Torben Voetmann | 6 |

Taxable Cash Dividends

Ken L. Bechman, Johannes Raaballe | 6 |

Rank papers for other periods

Top papers by Downloads last month (2024-03)

| Paper | Downloads |

Output and Expected Returns - a multicountry study

Jesper Rangvid | 2 |

Optionsaflønning i danske børsnoterede selskaber

Ken L. Bechmann, Peter Løchte Jørgensen | 2 |

Seasonality in Agricultural Commodity Futures

Carsten Sørensen | 2 |

Price and Volume Effects Associated with Changes in the Danish Blue-Chip Index - The KFX Index

Ken L. Bechmann | 2 |

Ny lov om jordforurening i økonomisk belysning

Henrik Lando | 2 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 1 |

Volatility-Adjusted Performance An Alternative Approach to Interpret Long-Run Returns

Jan Jakobsen, Torben Voetmann | 1 |

Upper Bounds on Numerical Approximation Errors

Peter Raahauge | 1 |

On valuation before and after tax in no arbitrage models: Tax neutrality in the discrete time model.

Bjarne Astrup Jensen | 1 |

Disclosed Values of Option-Based Compensation - Incompetence, Deliberate Underreporting or the Use of Expected Time to Maturity?

Ken L. Bechmann, Toke L. Hjortshøj | 1 |

Convergence in the ERM and declining numbers of common stochastic trends

Jesper Rangvid, Carsten Sørensen | 1 |

Term Structure Models with Parallel and Proportional Shifts

Frederik Armerin, Tomas Björk, Bjarne Astrup Jensen | 1 |

Taxable Cash Dividends

Ken L. Bechman, Johannes Raaballe | 1 |

The Value and Incentives of Option-based Compensation in Danish Listed Companies

Ken L. Bechmann, Peter Løchte Jørgensen | 1 |

Pensionsafkastbeskatning og optimal porteføljesammensætning

Jonas Aziz Bhatti, Michael Møller | 1 |

On Makeham's formula and xed income mathematics

Bjarne Astrup Jensen | 1 |

Does Ownership Matter? Evidence from Changes in Institutional and Strategic Investors' Equity Holdings

Robert Neumann, Torben Voetmann | 1 |

Empirical Rationality in the Stock Market

Peter Raahauge | 1 |

MOMSAFLØFTNING OG KREDITFORVRIDNING

Bjarne Florentsen, Michael Møller, Niels Chr. Nielsen | 1 |

The owner-occupiers’ capital structure during a house price boom

Jens Lunde | 1 |

Dynamic asset allocation and latent variables

Carsten Sørensen, Anders Bjerre Trolle | 1 |

Latent Utility Shocks in a Structural Empirical Asset Pricing Model

Bent Jesper Christensen, Peter Raahauge | 1 |

On a class of adjustable rate mortgage loans subject to a strict balance principle

Bjarne Astrup Jensen | 1 |

Lack of balance in after-tax returns - lack of tenure neutrality. The Danish case.

Jens Lunde | 1 |

Legal pre-emption rights as call-options, redistribution and efficiency loss

Michael Møller, Caspar Rose | 1 |

The Optimal Standard of Proof in Criminal Law When Both Fairness and Deterrence Matter

Henrik Lando | 1 |

Mean variance efficient portfolios by linear programming: A review of some portfolio selection criteria of Elton, Gruber and Padberg

Bjarne Astrup Jensen | 1 |

Lognormal Approximation of Complex Pathdependent Pension Scheme Payoffs

Peter Løchte Jørgensen | 1 |

Corporate Financial Performance and the Use of Takeover Defenses

Caspar Rose | 1 |

Impact of Takeover Defenses on Managerial Incentives

Caspar Rose | 1 |

Optimal Consumption and Investment Strategies with Stochastic Interest Rates

Carsten Sørensen, Claus Munk | 1 |

Evidence on the Limits of Arbitrage: Short Sales, Price Pressure, and the Stock Price Response to Convertible Bond Calls

Ken L. Bechmann | 1 |

On the Pricing of Step-Up Bonds in the European Telecom Sector

David Lando, Allan Mortensen | 1 |

On Volatility induced Stationarity for Stochastic Differential Equations

J.M.P J.M.PAlbin, Bjarne Astrup Jensen, Anders Muszta, Richter Martin | 1 |

Rank papers for other periods

Top papers by Abstract Accesses last 3 months (2024-01 to 2024-03)

| Paper | Accesses |

CEO Turnovers and Corporate Governance: Evidence from the Copenhagen Stock Exchange

Robert Neumann, Torben Voetmann | 21 |

Legal pre-emption rights as call-options, redistribution and efficiency loss

Michael Møller, Caspar Rose | 19 |

Changes in The Bid-Ask Components Around Earnings Announcements: Evidence from the Copenhagen Stock Exchange

Torben Voetmann | 18 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 17 |

The owner-occupiers’ capital structure during a house price boom

Jens Lunde | 16 |

Rating mutual funds

Ken L. Bechmann, Jesper Rangvid | 16 |

On Volatility induced Stationarity for Stochastic Differential Equations

J.M.P J.M.PAlbin, Bjarne Astrup Jensen, Anders Muszta, Richter Martin | 16 |

Disclosed Values of Option-Based Compensation - Incompetence, Deliberate Underreporting or the Use of Expected Time to Maturity?

Ken L. Bechmann, Toke L. Hjortshøj | 16 |

The housing price downturn and its effects ? a discussion

Jens Lunde | 16 |

Optimal Consumption and Investment Strategies with Stochastic Interest Rates

Carsten Sørensen, Claus Munk | 15 |

On the Pricing of Step-Up Bonds in the European Telecom Sector

David Lando, Allan Mortensen | 15 |

Rank papers for other periods

Top papers by Downloads last 3 months (2024-01 to 2024-03)

| Paper | Downloads |

Optionsaflønning i danske børsnoterede selskaber

Ken L. Bechmann, Peter Løchte Jørgensen | 2 |

Output and Expected Returns - a multicountry study

Jesper Rangvid | 2 |

Ny lov om jordforurening i økonomisk belysning

Henrik Lando | 2 |

Price and Volume Effects Associated with Changes in the Danish Blue-Chip Index - The KFX Index

Ken L. Bechmann | 2 |

Seasonality in Agricultural Commodity Futures

Carsten Sørensen | 2 |

Volatility-Adjusted Performance An Alternative Approach to Interpret Long-Run Returns

Jan Jakobsen, Torben Voetmann | 1 |

Upper Bounds on Numerical Approximation Errors

Peter Raahauge | 1 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 1 |

Empirical Rationality in the Stock Market

Peter Raahauge | 1 |

On Makeham's formula and xed income mathematics

Bjarne Astrup Jensen | 1 |

Does Ownership Matter? Evidence from Changes in Institutional and Strategic Investors' Equity Holdings

Robert Neumann, Torben Voetmann | 1 |

MOMSAFLØFTNING OG KREDITFORVRIDNING

Bjarne Florentsen, Michael Møller, Niels Chr. Nielsen | 1 |

Disclosed Values of Option-Based Compensation - Incompetence, Deliberate Underreporting or the Use of Expected Time to Maturity?

Ken L. Bechmann, Toke L. Hjortshøj | 1 |

Term Structure Models with Parallel and Proportional Shifts

Frederik Armerin, Tomas Björk, Bjarne Astrup Jensen | 1 |

Convergence in the ERM and declining numbers of common stochastic trends

Jesper Rangvid, Carsten Sørensen | 1 |

Taxable Cash Dividends

Ken L. Bechman, Johannes Raaballe | 1 |

On valuation before and after tax in no arbitrage models: Tax neutrality in the discrete time model.

Bjarne Astrup Jensen | 1 |

The Value and Incentives of Option-based Compensation in Danish Listed Companies

Ken L. Bechmann, Peter Løchte Jørgensen | 1 |

Pensionsafkastbeskatning og optimal porteføljesammensætning

Jonas Aziz Bhatti, Michael Møller | 1 |

Mean variance efficient portfolios by linear programming: A review of some portfolio selection criteria of Elton, Gruber and Padberg

Bjarne Astrup Jensen | 1 |

Corporate Financial Performance and the Use of Takeover Defenses

Caspar Rose | 1 |

Lognormal Approximation of Complex Pathdependent Pension Scheme Payoffs

Peter Løchte Jørgensen | 1 |

The Optimal Standard of Proof in Criminal Law When Both Fairness and Deterrence Matter

Henrik Lando | 1 |

Impact of Takeover Defenses on Managerial Incentives

Caspar Rose | 1 |

Latent Utility Shocks in a Structural Empirical Asset Pricing Model

Bent Jesper Christensen, Peter Raahauge | 1 |

The owner-occupiers’ capital structure during a house price boom

Jens Lunde | 1 |

Dynamic asset allocation and latent variables

Carsten Sørensen, Anders Bjerre Trolle | 1 |

Legal pre-emption rights as call-options, redistribution and efficiency loss

Michael Møller, Caspar Rose | 1 |

On a class of adjustable rate mortgage loans subject to a strict balance principle

Bjarne Astrup Jensen | 1 |

Lack of balance in after-tax returns - lack of tenure neutrality. The Danish case.

Jens Lunde | 1 |

On Volatility induced Stationarity for Stochastic Differential Equations

J.M.P J.M.PAlbin, Bjarne Astrup Jensen, Anders Muszta, Richter Martin | 1 |

Evidence on the Limits of Arbitrage: Short Sales, Price Pressure, and the Stock Price Response to Convertible Bond Calls

Ken L. Bechmann | 1 |

Optimal Consumption and Investment Strategies with Stochastic Interest Rates

Carsten Sørensen, Claus Munk | 1 |

On the Pricing of Step-Up Bonds in the European Telecom Sector

David Lando, Allan Mortensen | 1 |

Rank papers for other periods

Top papers by Abstract Accesses all months (from 2002-06)

Rank papers for other periods

Top papers by Downloads all months (from 2002-06)

Rank papers for other periods

Questions (including download problems) about the papers in this series should be directed to Lars Nondal ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2024-04-01 05:48:50.