Finance Research Group Working Papers,

University of Aarhus, Aarhus School of Business, Department of Business Studies

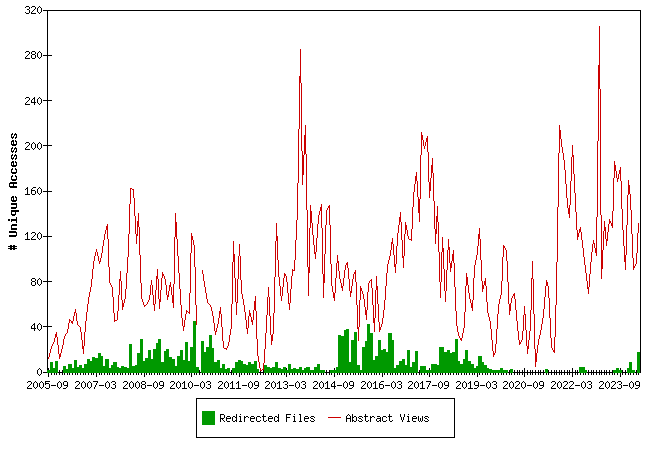

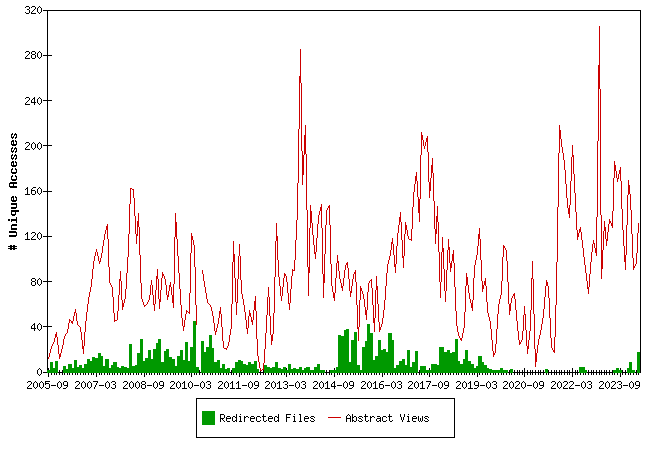

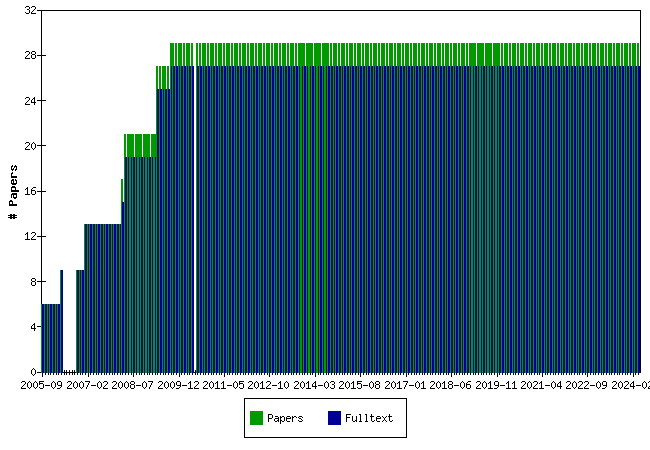

Downloads from EBLSG

Fulltext files are files downloaded from the EBLSG server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

The raw data

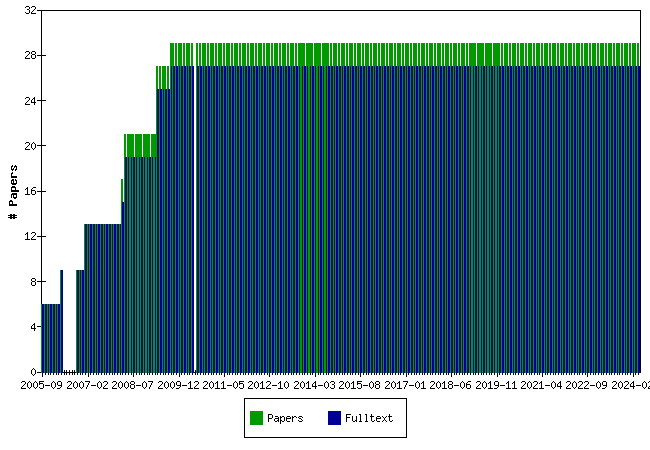

Papers at EBLSG

The raw data

Top papers by Abstract Accesses last month (2026-02)

| Paper | Accesses |

Pricing of Traffic Light Options and other Correlation Derivatives

Thomas Kokholm | 36 |

A Consistent Pricing Model for Index Options and Volatility Derivatives

Rama Cont, Thomas Kokholm | 32 |

Conducting event studies on a small stock exchange

Jan Bartholdy, Dennis Olson, Paula Peare | 31 |

Level-ARCH Short Rate Models with Regime Switching: Bivariate Modeling of US and European Short Rates.

Charlotte Christiansen | 30 |

The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application

Espen P. Høg, Per H. Frederiksen | 30 |

On the Generalized Brownian Motion and its Applications in Finance

Esben Høg, Per Frederiksen, Daniel Schiemert | 26 |

Traffic Light Options

Peter Løchte | 23 |

Estimating US Monetary Policy Shocks Using a Factor-Augmented Vector Autoregression: An EM Algorithm Approach

Lasse Bork | 22 |

Decomposing European bond and equity volatility

Charlotte Christiansen | 22 |

Lognormal Approximation of Complex Path-dependent Pension Scheme Payoffs

Peter Løchte Jørgensen | 21 |

Sato Processes in Default Modeling

Thomas Kokholm, Elisa Nicolato | 21 |

The Forecast Performance of Competing Implied Volatility Measures: The Case of Individual Stocks

Leonidas Tsiaras | 21 |

Improving the asset pricing ability of the Consumption-Capital Asset Pricing Model?

Anne-Sofie Reng Rasmussen | 21 |

Dispersed Trading and the Prevention of Market Failure: The Case of the Copenhagen Stock Exchange

David C. Porter, Carsten Tanggaard, Daniel G. Weaver, Wei Yu | 21 |

Rank papers for other periods

Top papers by Downloads last month (2026-02)

| Paper | Downloads |

Lapse Rate Modeling: A Rational Expectation Approach

Domenico De Giovanni | 5 |

GSE Funding Advantages and Mortgagor Benefits: Answers from Asset Pricing

Søren Willemann | 2 |

Level-ARCH Short Rate Models with Regime Switching: Bivariate Modeling of US and European Short Rates.

Charlotte Christiansen | 2 |

Dispersed Trading and the Prevention of Market Failure: The Case of the Copenhagen Stock Exchange

David C. Porter, Carsten Tanggaard, Daniel G. Weaver, Wei Yu | 2 |

Traffic Light Options

Peter Løchte | 2 |

Estimating US Monetary Policy Shocks Using a Factor-Augmented Vector Autoregression: An EM Algorithm Approach

Lasse Bork | 2 |

A Consistent Pricing Model for Index Options and Volatility Derivatives

Rama Cont, Thomas Kokholm | 1 |

Pricing of Traffic Light Options and other Correlation Derivatives

Thomas Kokholm | 1 |

Danish Mutual Fund Performance - Selectivity, Market Timing and Persistence.

Michael Christensen | 1 |

The Forecast Performance of Competing Implied Volatility Measures: The Case of Individual Stocks

Leonidas Tsiaras | 1 |

Investment decisions with benefits of control

Thomas Poulsen | 1 |

On the Generalized Brownian Motion and its Applications in Finance

Esben Høg, Per Frederiksen, Daniel Schiemert | 1 |

Investment Timing, Liquidity, and Agency Costs of Debt

Stefan Hirth, Marliese Uhrig-Homburg | 1 |

Rank papers for other periods

Top papers by Abstract Accesses last 3 months (2025-12 to 2026-02)

Rank papers for other periods

Top papers by Downloads last 3 months (2025-12 to 2026-02)

| Paper | Downloads |

Danish Mutual Fund Performance - Selectivity, Market Timing and Persistence.

Michael Christensen | 22 |

Investment Timing, Liquidity, and Agency Costs of Debt

Stefan Hirth, Marliese Uhrig-Homburg | 20 |

Lapse Rate Modeling: A Rational Expectation Approach

Domenico De Giovanni | 11 |

Habit persistence: Explaining cross-sectional variation in returns and time-varying expected returns

Stig Vinther Møller | 7 |

Dispersed Trading and the Prevention of Market Failure: The Case of the Copenhagen Stock Exchange

David C. Porter, Carsten Tanggaard, Daniel G. Weaver, Wei Yu | 5 |

Traffic Light Options

Peter Løchte | 5 |

The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application

Espen P. Høg, Per H. Frederiksen | 4 |

GSE Funding Advantages and Mortgagor Benefits: Answers from Asset Pricing

Søren Willemann | 4 |

Investment decisions with benefits of control

Thomas Poulsen | 4 |

Estimating US Monetary Policy Shocks Using a Factor-Augmented Vector Autoregression: An EM Algorithm Approach

Lasse Bork | 4 |

On the Generalized Brownian Motion and its Applications in Finance

Esben Høg, Per Frederiksen, Daniel Schiemert | 4 |

Rank papers for other periods

Top papers by Abstract Accesses all months (from 2005-09)

| Paper | Accesses |

A Consistent Pricing Model for Index Options and Volatility Derivatives

Rama Cont, Thomas Kokholm | 1326 |

The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application

Espen P. Høg, Per H. Frederiksen | 1274 |

Debt and Taxes: Evidence from bank-financed unlisted firms

Jan Bartholdy, Cesário Mateus | 1255 |

Danish Mutual Fund Performance - Selectivity, Market Timing and Persistence.

Michael Christensen | 1220 |

Traffic Light Options

Peter Løchte | 1212 |

Realized Bond-Stock Correlation: Macroeconomic Announcement Effects

Charlotte Christiansen, Angelo Ranaldo | 1197 |

Conducting event studies on a small stock exchange

Jan Bartholdy, Dennis Olson, Paula Peare | 1097 |

On the Generalized Brownian Motion and its Applications in Finance

Esben Høg, Per Frederiksen, Daniel Schiemert | 1048 |

Decomposing European bond and equity volatility

Charlotte Christiansen | 1042 |

Paying for Market Quality

Amber Anand, Carsten Tanggaard, Daniel G. Weaver | 1033 |

Rank papers for other periods

Top papers by Downloads all months (from 2005-09)

| Paper | Downloads |

Pricing the Option to Surrender in Incomplete Markets

Andrea Consiglio, Domenico De Giovanni | 296 |

Lapse Rate Modeling: A Rational Expectation Approach

Domenico De Giovanni | 147 |

The Fractional Ornstein-Uhlenbeck Process: Term Structure Theory and Application

Espen P. Høg, Per H. Frederiksen | 147 |

Danish Mutual Fund Performance - Selectivity, Market Timing and Persistence.

Michael Christensen | 146 |

Conducting event studies on a small stock exchange

Jan Bartholdy, Dennis Olson, Paula Peare | 115 |

Debt and Taxes: Evidence from bank-financed unlisted firms

Jan Bartholdy, Cesário Mateus | 97 |

A Consistent Pricing Model for Index Options and Volatility Derivatives

Rama Cont, Thomas Kokholm | 91 |

Investment Timing, Liquidity, and Agency Costs of Debt

Stefan Hirth, Marliese Uhrig-Homburg | 81 |

Realized Bond-Stock Correlation: Macroeconomic Announcement Effects

Charlotte Christiansen, Angelo Ranaldo | 78 |

Traffic Light Options

Peter Løchte | 72 |

Rank papers for other periods

Questions (including download problems) about the papers in this series should be directed to Helle Vinbaek Stenholt ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2026-03-01 05:51:58.