Working Papers,

Copenhagen Business School, Department of Finance

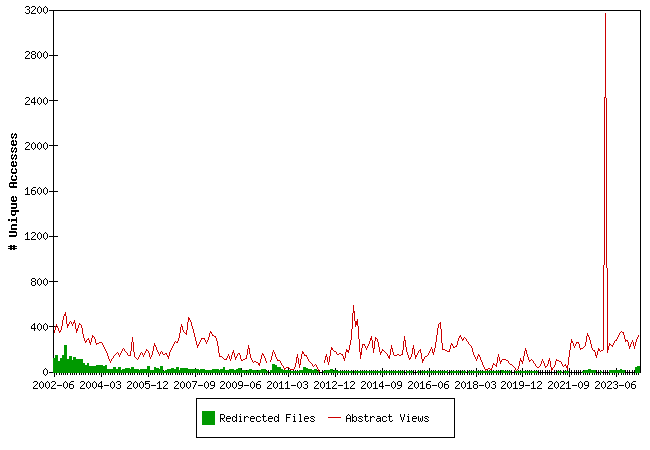

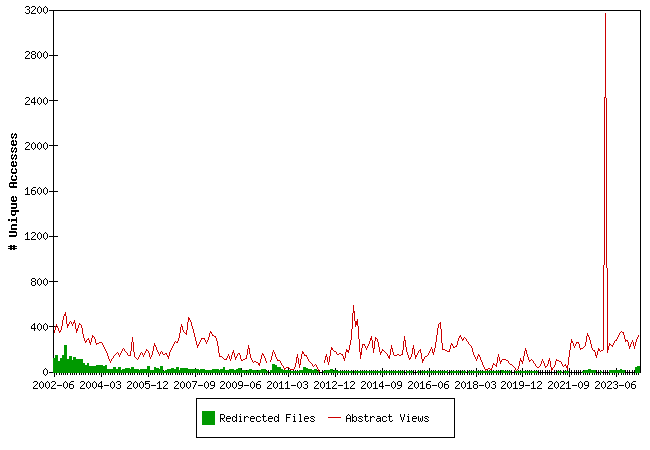

Downloads from EBLSG

Fulltext files are files downloaded from the EBLSG server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

The raw data

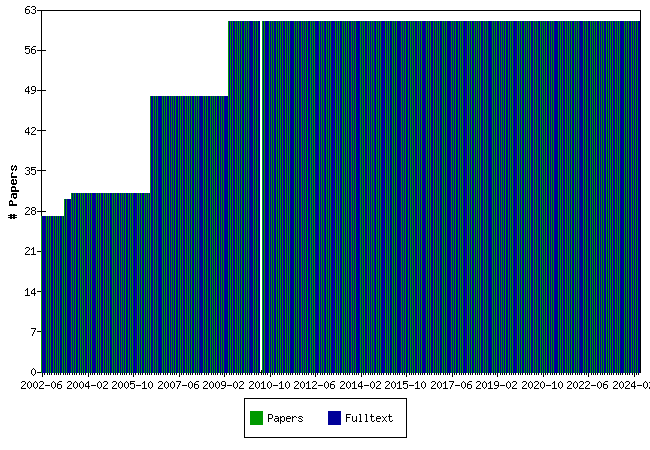

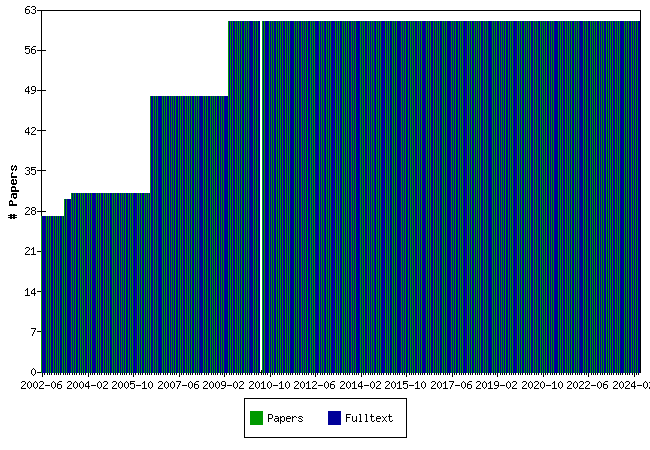

Papers at EBLSG

The raw data

Top papers by Abstract Accesses last month (2026-02)

| Paper | Accesses |

Modelling Callable Annuity Bonds with Interest-Only Optionality

Anders Holst, Morten Nalholm | 33 |

The owner-occupiers’ capital structure during a house price boom

Jens Lunde | 28 |

Evidence on the Limits of Arbitrage: Short Sales, Price Pressure, and the Stock Price Response to Convertible Bond Calls

Ken L. Bechmann | 28 |

Optimal Consumption and Investment Strategies with Stochastic Interest Rates

Carsten Sørensen, Claus Munk | 26 |

Stochastic Volatility and Seasonality in Commodity Futures and Options: The Case of Soybeans

Martin Richter, Carsten Sørensen | 25 |

On Makeham's formula and xed income mathematics

Bjarne Astrup Jensen | 24 |

CEO Turnovers and Corporate Governance: Evidence from the Copenhagen Stock Exchange

Robert Neumann, Torben Voetmann | 24 |

The Differences Between Stock Splits and Stock Dividends

Ken L. Bechmann, Johannes Raaballe | 24 |

The Choice of Monetary Regime

Finn Østrup | 22 |

Energy Options in an HJM Framework

Thomas Lyse Hansen, Bjarne Astrup Jensen | 22 |

Legal pre-emption rights as call-options, redistribution and efficiency loss

Michael Møller, Caspar Rose | 22 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 22 |

Rank papers for other periods

Top papers by Downloads last month (2026-02)

| Paper | Downloads |

Disclosed Values of Option-Based Compensation - Incompetence, Deliberate Underreporting or the Use of Expected Time to Maturity?

Ken L. Bechmann, Toke L. Hjortshøj | 9 |

Accounting Transparency and the Term Structure of Credit Default Swap Spreads

Claus Bajlum, Peter Tind Larsen | 7 |

Impact of Investor Meetings/Presentations on Share Prices, Insider Trading and securities Regulation

Caspar Rose | 6 |

Lack of balance in after-tax returns - lack of tenure neutrality. The Danish case.

Jens Lunde | 5 |

Does Ownership Matter? Evidence from Changes in Institutional and Strategic Investors' Equity Holdings

Robert Neumann, Torben Voetmann | 5 |

The Impact of Bankruptcy Rules on Risky Project Choice and Skill Formation under Credit Rationing

Shubhashis Gangopadhyay, Clas Wihlborg | 5 |

Distributions of owner-occupiers' housing wealth, debt and interest expenditureratios as financial soundness indicators

Jens Lunde | 4 |

Latent Utility Shocks in a Structural Empirical Asset Pricing Model

Bent Jesper Christensen, Peter Raahauge | 4 |

On Volatility induced Stationarity for Stochastic Differential Equations

J.M.P J.M.PAlbin, Bjarne Astrup Jensen, Anders Muszta, Richter Martin | 4 |

On valuation before and after tax in no arbitrage models: Tax neutrality in the discrete time model.

Bjarne Astrup Jensen | 4 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 4 |

Capital Structure Arbitrage: Model Choice and Volatility Calibration

Claus Bajlum, Peter Tind Larsen | 4 |

Corporate Financial Performance and the Use of Takeover Defenses

Caspar Rose | 4 |

Rank papers for other periods

Top papers by Abstract Accesses last 3 months (2025-12 to 2026-02)

Rank papers for other periods

Top papers by Downloads last 3 months (2025-12 to 2026-02)

| Paper | Downloads |

Corporate Financial Performance and the Use of Takeover Defenses

Caspar Rose | 17 |

Does Ownership Matter? Evidence from Changes in Institutional and Strategic Investors' Equity Holdings

Robert Neumann, Torben Voetmann | 17 |

On valuation before and after tax in no arbitrage models: Tax neutrality in the discrete time model.

Bjarne Astrup Jensen | 16 |

Disclosed Values of Option-Based Compensation - Incompetence, Deliberate Underreporting or the Use of Expected Time to Maturity?

Ken L. Bechmann, Toke L. Hjortshøj | 15 |

Term Structure Models with Parallel and Proportional Shifts

Frederik Armerin, Tomas Björk, Bjarne Astrup Jensen | 15 |

On Volatility induced Stationarity for Stochastic Differential Equations

J.M.P J.M.PAlbin, Bjarne Astrup Jensen, Anders Muszta, Richter Martin | 14 |

MOMSAFLØFTNING OG KREDITFORVRIDNING

Bjarne Florentsen, Michael Møller, Niels Chr. Nielsen | 12 |

Seasonality in Agricultural Commodity Futures

Carsten Sørensen | 11 |

Foundation ownership and financial performance. Do companies need owners?

Steen Thomsen, Caspar Rose | 11 |

Accounting Transparency and the Term Structure of Credit Default Swap Spreads

Claus Bajlum, Peter Tind Larsen | 11 |

Rank papers for other periods

Top papers by Abstract Accesses all months (from 2002-06)

Rank papers for other periods

Top papers by Downloads all months (from 2002-06)

Rank papers for other periods

Questions (including download problems) about the papers in this series should be directed to Lars Nondal ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2026-03-01 05:52:00.